Are you wondering how to add fine jewelry to your home insurance policy? Fine jewelry is not only valuable in terms of finances and sentiment but also poses a potential risk for loss or damage. This article aims to provide a comprehensive guide on understanding the value of fine jewelry, the importance of adding it to your home insurance policy, different types of coverage available, and steps to inventory and appraise your jewelry.

Fine jewelry holds significant emotional and financial value for many individuals. Whether it’s an heirloom piece passed down through generations or a luxury purchase, protecting these treasures should be a top priority. Understanding the worth of your fine jewelry is crucial when considering adding it to your home insurance policy. This includes assessing its market value, sentimental value, and potential for loss or damage.

Adding fine jewelry to your home insurance policy is essential for ensuring proper protection against loss, theft, or damage. It provides peace of mind knowing that your prized possessions are safeguarded. However, determining the right type of coverage and ensuring adequate protection requires careful consideration. This article will explore the various types of home insurance coverage available for fine jewelry and provide tips for ensuring sufficient coverage based on individual needs and circumstances.

Understanding the Value of Fine Jewelry

Fine jewelry holds immense value, both financially and sentimentally. Understanding the worth of your fine jewelry is crucial for ensuring that it is adequately protected under your home insurance policy.

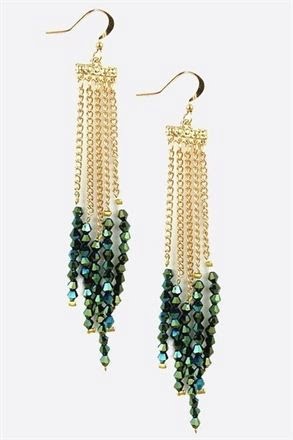

Fine jewelry includes items such as engagement rings, wedding bands, necklaces, bracelets, earrings, and other pieces made from precious metals and gemstones. It’s important to recognize the value of these items not only in terms of their original purchase price, but also the potential increase in value over time due to inflation and appreciation.

Appraising Your Fine Jewelry

Before adding your fine jewelry to your home insurance policy, it’s essential to have your pieces appraised by a reputable jeweler or appraiser. An appraisal will determine the current market value of each item based on factors such as the quality of materials, craftsmanship, and overall desirability. This evaluation will provide you with an accurate understanding of the total value of your fine jewelry collection and ensure that you have adequate coverage under your home insurance policy.

Understanding Insurance Coverage Limits

When it comes to insuring fine jewelry, it’s crucial to understand the coverage limits of your existing home insurance policy. Many standard policies impose limits on the amount of coverage for valuable items like jewelry. These limits may not be sufficient to fully protect high-value items.

Understanding these limitations will help you determine whether additional coverage or a separate rider specifically for your fine jewelry is necessary. Understanding the actual cash value versus replacement cost coverage options is also vital in determining how much reimbursement you would receive in the event of a loss or damage.

Importance of Adding Fine Jewelry to Home Insurance Policy

Fine jewelry is a valuable and cherished possession for many homeowners. From engagement rings to family heirlooms, these pieces hold sentimental and monetary value. It is essential to ensure that your fine jewelry is adequately protected in case of loss, theft, or damage. This is where adding fine jewelry to your home insurance policy becomes crucial.

Understanding the value of fine jewelry is the first step in recognizing the importance of adding it to your home insurance policy. Fine jewelry includes items such as diamond rings, gemstone necklaces, luxury watches, and other high-value pieces. These items often appreciate over time, making it essential to have them appraised regularly to determine their current worth. Adding these valuable items to your home insurance policy provides financial protection against unforeseen circumstances.

There are several types of home insurance coverage options available for fine jewelry. Here are some common types:

- Scheduled Personal Property Coverage: This type of coverage allows you to specifically list and insure individual pieces of fine jewelry on your policy.

- Blanket Coverage: This option provides a set amount of coverage for all valuable personal property, including fine jewelry, without requiring specific itemization.

- Additional Endorsements: You may also have the option to add endorsements or riders to your existing home insurance policy to increase coverage limits for your fine jewelry.

Now that you understand the importance of adding fine jewelry to your home insurance policy and the various coverage options available, let’s take a closer look at how you can go about doing so.

Types of Home Insurance Coverage for Fine Jewelry

When it comes to protecting your valuable fine jewelry, adding it to your home insurance policy is a crucial step. But before doing so, it’s essential to understand the different types of home insurance coverage available for fine jewelry. Here are the options you can consider when adding your precious items to your policy:

1. Scheduled Personal Property Coverage: This type of coverage allows you to specifically list and insure individual high-value items on your home insurance policy. You will need to provide appraisals and detailed descriptions of each piece of jewelry you want to include.

2. Blanket Coverage: With this type of coverage, a set amount of coverage is assigned to all of your personal property, including jewelry. It provides coverage for a wide range of perils such as theft, loss, or damage.

3. Endorsement or Rider: An endorsement or rider is an addition to your existing homeowners insurance policy that provides extra coverage for specific items like fine jewelry. This allows you to increase the coverage limits specifically for your valuable pieces.

When adding fine jewelry to your home insurance policy, considering these types of coverage options can help ensure that your precious items are adequately protected in case of any unforeseen event.

By understanding the different types of coverage available, you can choose the best option that suits the value and unique needs of your fine jewelry collection. Be sure to consult with your insurance agent or broker to determine the most suitable type of coverage for your specific situation.

How to Inventory and Appraise Your Fine Jewelry

When it comes to protecting your fine jewelry, it’s important to have a clear inventory and appraisal of each piece. This ensures that in the event of loss or damage, you can accurately report the value of the items to your insurance company. Here’s a step-by-step guide on how to inventory and appraise your fine jewelry for home insurance purposes.

Creating a Detailed Inventory

The first step in adding your fine jewelry to your home insurance policy is to create a detailed inventory of all your pieces. This should include a description of each item, including the type of jewelry (e.g. ring, necklace, bracelet), the materials it’s made from, any gemstones or diamonds, and any distinguishing features. It’s also helpful to include photographs of each piece from multiple angles.

Obtaining Appraisals

Once you have a detailed inventory of your fine jewelry, the next step is to obtain professional appraisals for each item. An appraisal provides an accurate valuation of the piece based on factors such as market value, craftsmanship, and materials used. It’s important to have these appraisals conducted by certified gemologists or appraisers who are recognized by reputable organizations such as the Gemological Institute of America (GIA) or the American Gem Society (AGS).

Keeping Records Secure

After creating a detailed inventory and obtaining professional appraisals for your fine jewelry, it’s crucial to keep these records secure. Consider storing digital copies of your inventory and appraisals in a secure cloud storage service or safe deposit box. This ensures that you have access to this information in case of an emergency or disaster. Additionally, keeping physical copies in a safe and secure location can provide extra peace of mind.

By following these steps to inventory and appraise your fine jewelry, you will be well-prepared to add these valuable items to your home insurance policy with confidence. Having precise records will not only streamline the process but also ensure that you receive adequate coverage for your prized possessions in case of loss or damage.

Remember that adding fine jewelry to home insurance policy involves detailing every single piece with their respective appraisal values and submitting this information to insurers for coverage inclusion into the policy.

Step-by-Step Guide to Adding Fine Jewelry to Home Insurance Policy

Adding fine jewelry to your home insurance policy is a smart way to protect your valuable pieces in case of loss or damage. Here’s a step-by-step guide to help you navigate the process and ensure that your fine jewelry is properly covered by your home insurance policy.

The first step in adding fine jewelry to your home insurance policy is to gather all the necessary information about your valuable pieces. This includes detailed descriptions, appraisals, and photographs of each item. If you have any original receipts or paperwork related to the jewelry, be sure to keep them handy as well.

Next, contact your home insurance provider to inquire about adding a rider or endorsement specifically for your fine jewelry. A rider is an additional coverage that can be added to your existing policy to cover specific high-value items like fine jewelry. An endorsement, on the other hand, may modify certain terms of your policy to provide adequate coverage for your valuable pieces.

Once you have chosen the right option for adding coverage for your fine jewelry, work with your insurance agent to complete the necessary paperwork and pay any additional premiums required. Be prepared to provide all the information and documentation gathered in the first step, as this will be essential for accurately insuring your valuable pieces.

Following these steps will ensure that you have taken the necessary measures to add fine jewelry to your home insurance policy and protect your valuable pieces from potential loss or damage.

| Steps | Description |

|---|---|

| Gather Information | Collect detailed descriptions, appraisals, and photographs of each item; keep original receipts if available. |

| Contact Insurance Provider | Inquire about adding a rider or endorsement specifically for fine jewelry; choose the right option based on their advice. |

| Complete Paperwork | Work with insurance agent to complete necessary paperwork and pay additional premiums. |

Tips for Ensuring Adequate Coverage for Fine Jewelry

As a jewelry owner, it is essential to ensure that your valuable pieces are adequately protected in the event of loss, damage, or theft. The first step in guaranteeing this protection is understanding the type and amount of coverage you have for your fine jewelry under your home insurance policy.

One approach to ensuring adequate coverage for fine jewelry is to determine the limits of coverage provided by your existing home insurance policy. Some policies have a sub-limit on certain categories of personal property, such as jewelry, which may not be sufficient to cover the full value of your pieces. In this case, you may need to consider purchasing an endorsement or rider specifically for your fine jewelry.

Another tip for ensuring adequate coverage for fine jewelry is to obtain an updated appraisal for each piece. The value of precious metals and gemstones can fluctuate over time due to market conditions, so it is crucial to have regular appraisals to accurately reflect the current value of your jewelry.

Additionally, you can consider purchasing special “floater” insurance specifically designed for high-value items like fine jewelry. This type of coverage can provide broader protection than a standard home insurance policy and may also cover situations that are typically excluded from regular policies, such as accidentally dropping a ring down the drain or losing an earring while traveling.

| Tips for Ensuring Adequate Coverage | Data |

|---|---|

| Review the sub-limits on personal property in your home insurance policy | Understand whether additional endorsements or riders are necessary |

| Obtain regular appraisals for accurate valuation | Consider purchasing specialized “floater” insurance for high-value items |

What to Do in Case of Fine Jewelry Loss or Damage

If you’ve taken the necessary steps to add your fine jewelry to your home insurance policy and have experienced loss or damage, it’s important to know what to do next. Whether your jewelry has been stolen, lost, or damaged, there are specific actions you can take to ensure proper compensation from your insurance company.

The first step to take in case of fine jewelry loss or damage is to contact your insurance company immediately. They will guide you through the necessary steps for filing a claim and may also require documentation such as a police report (in case of theft) or an appraisal of the damaged item. It’s important to provide as much detail as possible about the circumstances surrounding the loss or damage.

Once you’ve reported the loss or damage to your insurance company, they will likely request an appraisal of the fine jewelry item. If you haven’t already done so, this step can help determine the actual value of the piece and aid in the claims process. An independent appraiser can provide a current assessment of the item’s worth based on its condition and market value, which can be crucial in receiving adequate compensation.

In some cases, your insurance policy may cover temporary replacement of the lost or damaged item while your claim is being processed. This coverage can help alleviate any inconvenience caused by the absence of your fine jewelry piece.

Be sure to review your policy details and discuss this option with your insurance provider if it applies. Taking these steps in case of fine jewelry loss or damage can help ensure a smooth claims process and proper compensation from your home insurance policy.

Reviewing and Updating Fine Jewelry Coverage in Home Insurance Policy

In conclusion, it is essential for homeowners to understand the value of their fine jewelry and the importance of adding it to their home insurance policy. Fine jewelry holds both financial and sentimental value, making it crucial to protect against loss or damage. By understanding the types of coverage available for fine jewelry and following a step-by-step guide to adding it to a home insurance policy, homeowners can ensure adequate protection.

One of the key aspects of protecting fine jewelry is to inventory and appraise the pieces accurately. This will not only help in determining the appropriate coverage needed but also streamline the process in case of loss or damage. Additionally, homeowners should regularly review and update their fine jewelry coverage in their home insurance policy, especially if new pieces are acquired or if there are fluctuations in the market value.

It is important to note that in the unfortunate event of fine jewelry loss or damage, homeowners should immediately reach out to their insurance provider and follow any necessary steps for filing a claim. By being proactive and thorough in maintaining accurate records, homeowners can have peace of mind knowing that their cherished fine jewelry is adequately protected under their home insurance policy. Following these guidelines will ensure that homeowners have the necessary coverage for their valuable assets.

Frequently Asked Questions

Can You Add Jewelry to Homeowners Insurance?

Yes, you can typically add jewelry to your homeowners insurance policy. Most policies have coverage limits for jewelry, so if your collection exceeds that limit, you may need to purchase additional coverage specifically for your jewelry.

Can You Put Jewelry on House Insurance?

Yes, you can include jewelry in your house insurance by adding a rider or endorsement to your policy. This will provide extra coverage specifically for your jewelry, protecting it from theft, loss, or damage beyond the standard coverage in your policy.

How Do I Put a Ring on My Home Insurance?

To add a ring or any other valuable piece of jewelry to your home insurance, you should contact your insurance provider and inquire about adding a rider or endorsement to your policy. They will likely request an appraisal of the ring to determine its value before offering the additional coverage.

Keep in mind that some insurers may require specific security measures for high-value items, such as safes or alarm systems.

Welcome to my jewelry blog! My name is Sarah and I am the owner of this blog.

I love making jewelry and sharing my creations with others.

So whether you’re someone who loves wearing jewelry yourself or simply enjoys learning about it, be sure to check out my blog for insightful posts on everything related to this exciting topic!